A Long Trade Idea in the EC (EURUSD)? Yes, really!

17

November, 2016

The EC / EURUSD is rapidly approaching prior swing lows and have set up divergences. Divergences located at prior support areas tend to lead to at least a small rally.

There is also a ton of bearish opinions over the EURO right now so its possible that sentiment, being an inverse indicator, could be supportive of an EC bounce as well.

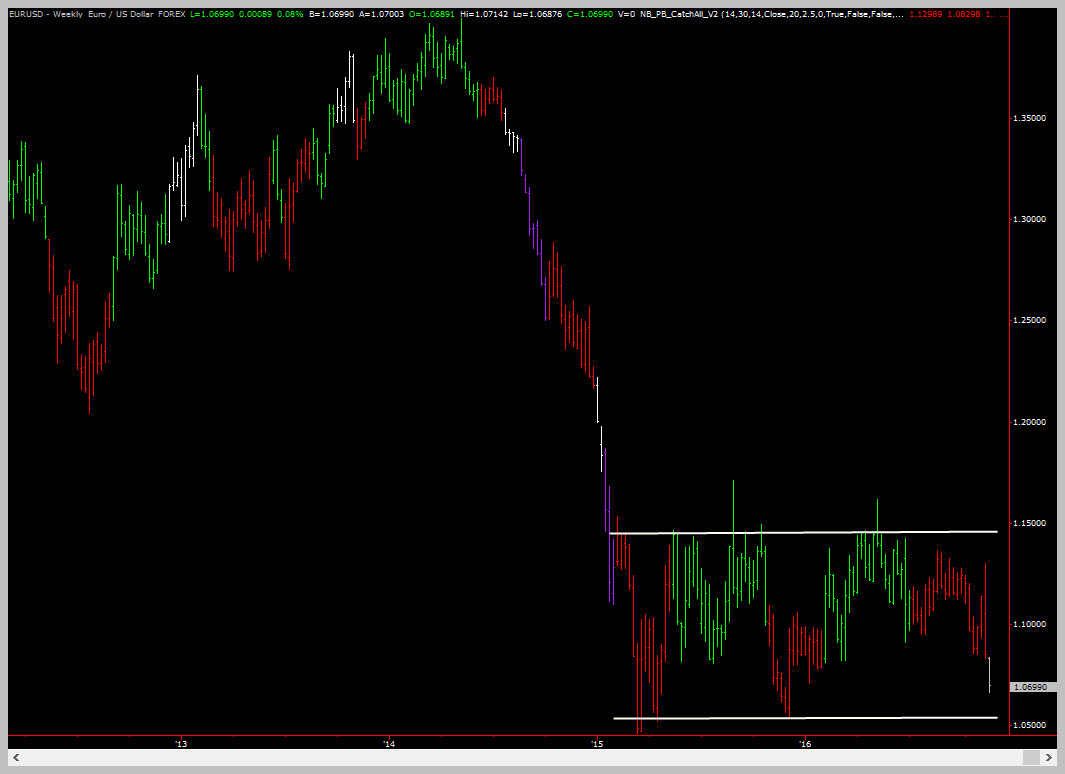

Lets start off with a look at the weekly EC chart…

After a massive down-trend that started in 2014, this cross-rate has carved out a 2 year sideways line – and is now approaching the lower level of that price action.

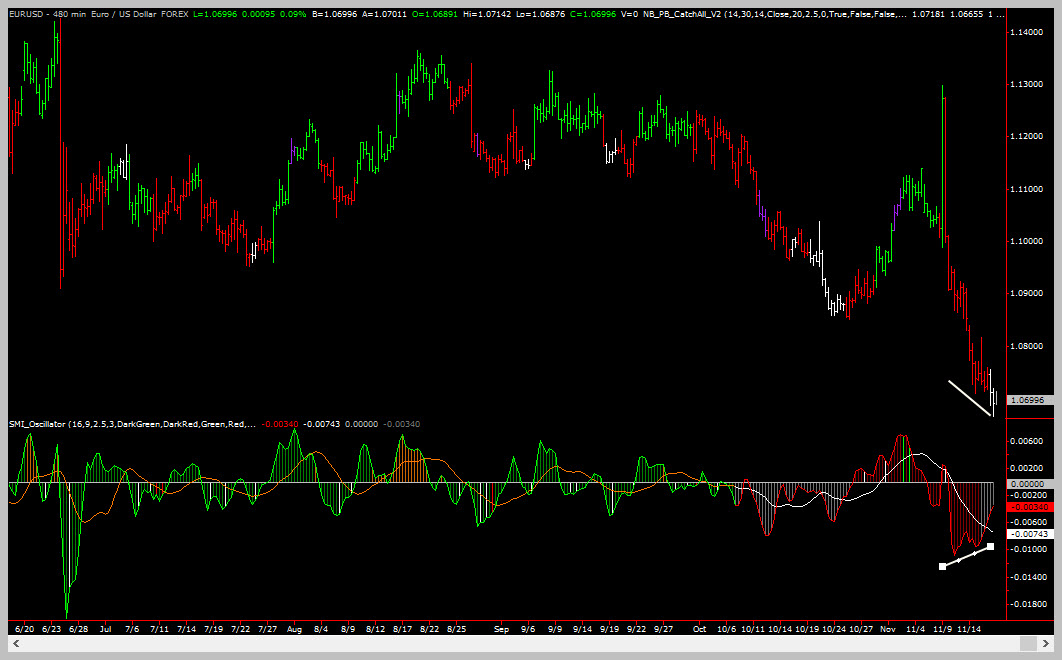

On an intraday chart, the price is sporting buy divergences. Divergences form when the price chart is making lower lows but momentum based oscillators are making higher lows. (There are some other qualifying criteria but that’s for another day).

Take a look..

The diagonal white lines on the lower right-hand side of the chart show the divergences – you can see that the price in the top pane is making lower lows while the oscillator was making higher lows.

Now, make no mistake about this – the EC is in a DOWNTREND on almost all time frames. This is a SCALP Trade – you might get 50-100 ticks out of it, maybe a little more. We would classify this trade idea as AGGRESSIVE.

To that end, here are THREE trading ideas suitable for different risk profiles

Trade Idea #1

Entry: Buy at the market.

Exit: Exit your position when your favorite short-term momentum oscillator pushes above zero or when you’ve gained 50-100 ticks.

Protective Stop Order: 1.066 (basis EURUSD)

Trade Idea #2

Entry: Buy at the market.

Exit: The first bar that shows profit when it opens.

Protective Stop Order: 1.066 (basis EURUSD)

EURUSD Buy Divergences on 480 Min Chart

Photograph provided by canstockphoto.com

Wrap Up

There is a short-term long set up in the EURUSD for ahe aggressive trader or the trader who likes to trade counter-trend.

This is a scalp trade but, for the really aggressive trader, there is a way to hold for longer – just in case price gets to the upper end of the weekly range!

PS: don’t forget – if you have questions about the techniques used in this article, a simple 1 hour technical analysis coaching session can get all your questions answered!