Analysis: US Nasdaq Futures At Support

06

November, 2016

The US Nasdaq index has hit an area of strong support. After last week’s rout the index is sitting at the September 2016 lows and July / August 2015 highs. Those highs were a resistance level and have now become support.

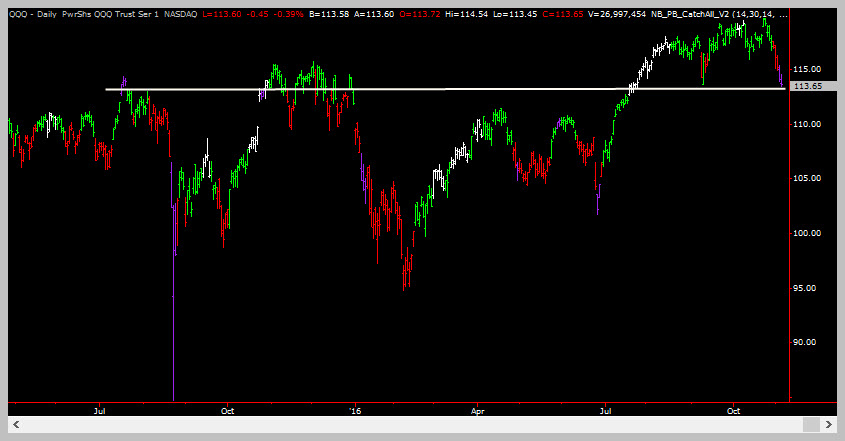

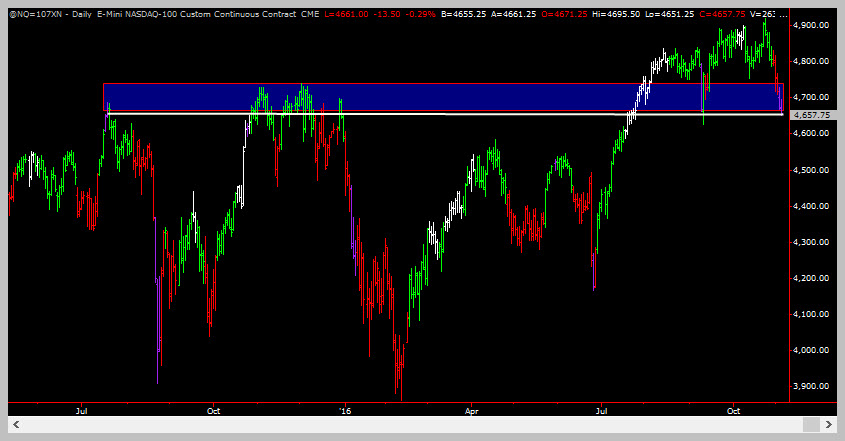

Lets take a look at the charts. We’ll look at both the NQ (CME Futures) and QQQ (stock ETF) charts.

The first chart is the QQQ while the second chart is the NQ (mini-nasdaq futures traded on the CME). The horizontal white line represents the support level while the horizontal blue rectangle represents a support AREA. While we don’t like it when prices get to the bottom of a support AREA, we know that the overall trend is UP and that the elections are probably a reason for the push lower in all these equity markets.

What kinds of trades can we make here in preparation for a possible resumption of the uptrend? There are at least three possible trades that can be used to express a bullish sentiment. Here they are:

Trade Idea #1

Buy QQQ calls. With the market selling off, its going to present a buying opportunity for call options with strike prices 10% or so above the current price.

Trade Idea #2

Sell VIX put options. But to be safe, you’ll want to do VIX put spreads so that you can limit your risk.

Trade Idea #3

Wait till our chart swings turn green again – this indicates a potential resumption of the trend. Buy at the market when that happens and set a protective stop at the swing low that occurs as a result of that event.

(If you’d like to know what the RED and GREEN swings are on our charts, sign up for a one hour coaching session. You will be surprised what you can learn in 60 minutes!)

Which Trade Is Best?

All the trades are overwhelmingly bullish trades. Buying straight QQQ calls are best for the options newbie. Selling VIX options is probably best left to the options expert. The third trade idea is probably the safest idea but you pay the price for waiting – you’ll miss the first leg back up. But that doesn’t mean that its not a good trade – in fact its a great trade idea for the conservative trader!

NQ Is At Support

Photograph provided by shutterstock.com

Wrap Up

The NQ presents a few intriguing trading possibilties now that it has hit a nice support area. Over the next couple of days volatility is likely to be high and this presents an opportunity to get positioned to resume the dominant trend (which is up on both the daily and weekly time frames.) While we didn’t show it, charts for sentiment and unused cash are also in bullish territory.

PS: don’t forget – if you have questions about the techniques used in this article, a simple 1 hour technical analysis coaching session can get all your questions answered!