Coffee – Long Trade Idea

30

November, 2016

Coffee futures have been in an uptrend for most of 2016. Now it has pulled back to an area where price spent a lot of time earlier this year (and even last year). This presents a potential swing trade opportunity.

Obviously no one can tell with certainty if the up-trend is over but we can attempt to structure a trade that puts the odds in our favor. Price at support along with oversold oscillators while still in an uptrend stacks the deck in our favor.

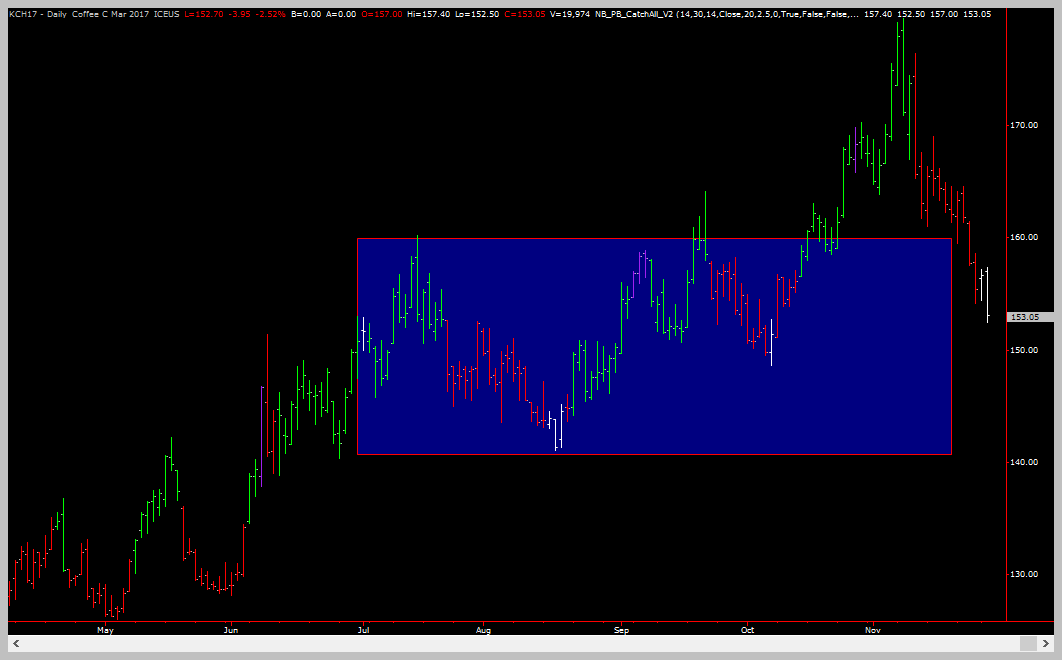

Lets start off as usual with a look at the daily chart

The above chart is based on the March 2017 Coffee Futures contract traded on the CME. A chart of CAFE, a coffee ETF will show a similar structure – just with a lot of gaps.

The area in blue is the prior consolidation – you can see that there are some price bar overlap going on there. Now, price has retraced back to this area. This presents us with a long trade opportunity and multiple ways to trade it.

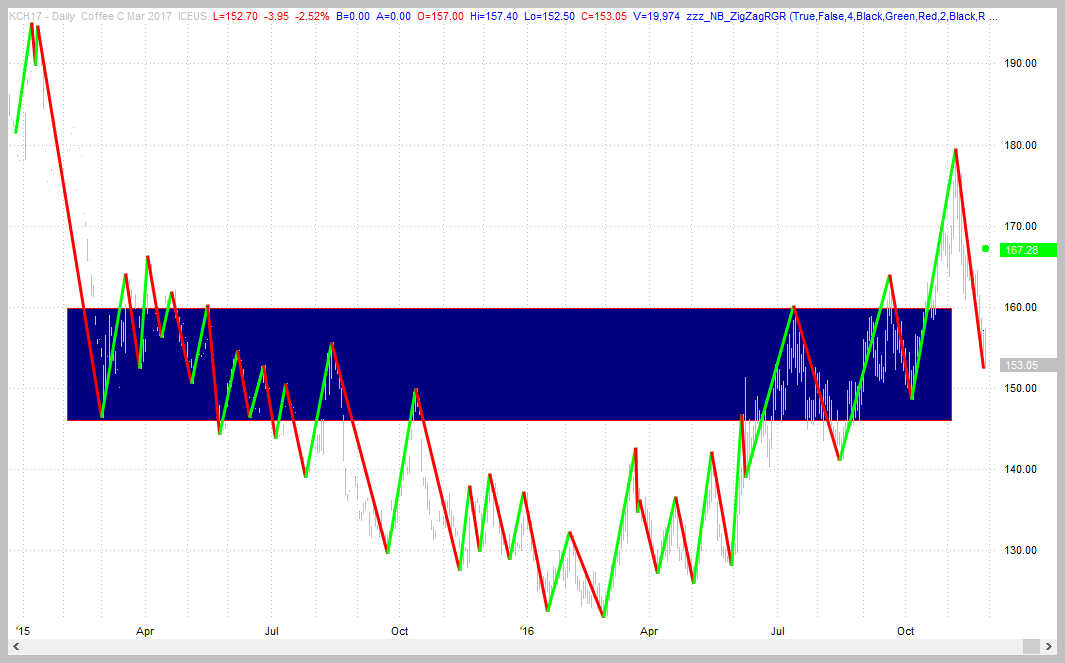

For those of you who would like to visually see the up-trend, here’s what that looks like when all the price-bars are faded into the background and only the swings are shown:

You can see on this chart that there is a clear uptrend on the right hand side. And the blue box showing the prior consolidation area also encompasses a similar consolidation in the same area back in 2015 – validating the support area thesis that we’re working with.

So, here are three trading ideas suitable for different risk profiles

Trade Idea #1

Entry: Buy at the market.

Exit: Exit your position when your favorite short-term momentum oscillator pushes to overbought.

Protective Stop Order: 3 ATRs from your entry order.

Trade Idea #2

Entry: Wait for the daily chart to close with a green swing bar.

Exit: Exit 50% of your position when you have a 1 ATR gain; exit the rest at new contract highs.

Protective Stop Order: At the swing low created when the green swing occurs.

KC Futures are at a support level!

Photograph provided by canstockphoto.com

Wrap Up

Coffee is in a support area. It can go lower but the odds are that somewhere in here price will move back up to an area considered “overbought” on oscillators. In other words, there is at least a swing trade potential here.

The trick with Coffee is to make sure you have your STOPS in place. This market moves like the wind and is very volatile. So make sure you respect your stop levels. You can always get back in if stopped out.

PS: don’t forget – if you have questions about the techniques used in this article, a simple 1 hour technical analysis coaching session can get all your questions answered!