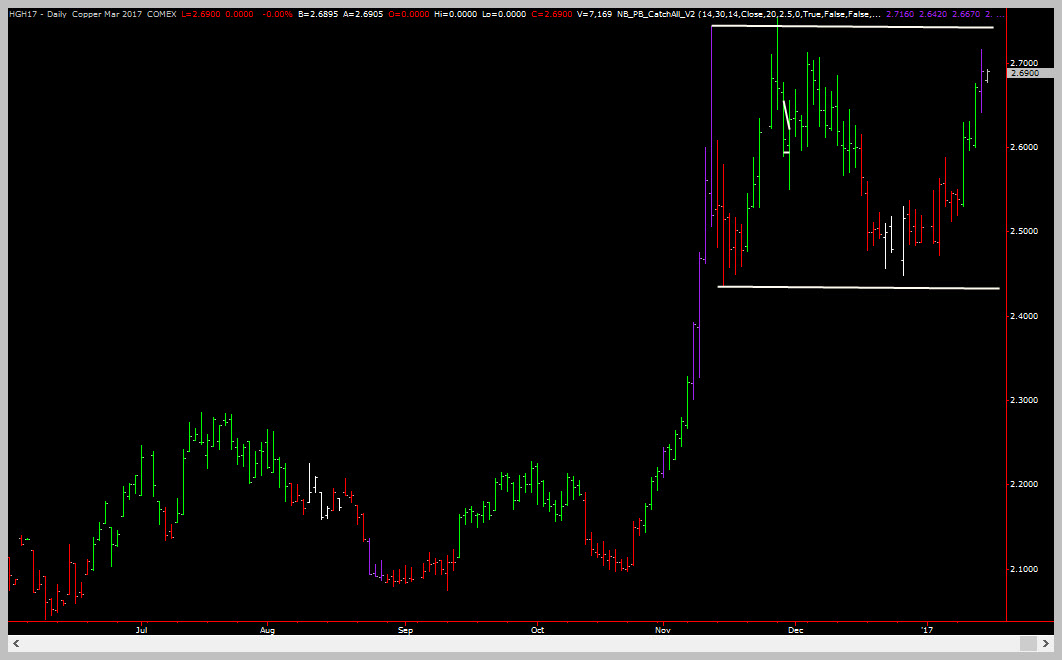

Copper (HG) Critical Point (Short / Long Play)

15

January, 2017

After a large impulse to the upside, Copper futures are starting to carve out a giant trading range valued around $7500 USD (measured from low to high).

Now, it looks like this market is close to the upper end of the range which opens up a number of potential trading options.

One of the things we need to realize is that when a market hits the upper or lower end of a trading range, it is really at a critical point. This is because the market can turn and run back to the other end of the range OR it can breakout from the range. As a trader we have to be prepared for either scenario.

Having said that, lets take a look at the Copper Futures (March 2017, CME) chart.

In the image above you can see the trading range marked with the two horizontal white lines. Friday’s bar is the last purple bar on the right (we’ll cover the meaning of that purple bar in a future article). You can see clearly that we are heading into the upper end of the range.

So here are three different trading ideas depending on whether or not a breakout actually occurs

Trade Idea #1

Buy At The Market – This is the most aggressive option.

Entry: Buy at the market – ES, SPY, NQ. NQ is the strongest market but ES is the broadest.

Exit: Exit 50% of your position when the ES gets above 2180 (close to highs). Pull stop to breakeven and hold the rest for an upside breakout.

Protective Stop: Exit your position upon a CLOSE below 2128 (back inside the consolidation..)

Trade Idea #2

Play for a move back to the lower end of the range.

Entry: Wait for a 5 minute trend reversal back to the downside.

Exit: Take profits at or below 2.50

Protective Stop: Exit your entire position on a close above the high of the 5 min trend reversal

Retry: Retry the trade 3 TIMES before giving up.

Trade Idea #3

Play for a move back to the lower end of the range. This is a longer term alternative to Trade Idea #2

Entry: Wait for a 15 minute trend reversal back to the downside.

Exit: Take profits at or below 2.50

Protective Stop: Exit your entire position on a close above the high of the 15 min trend reversal

Retry: Retry the trade 1 more time before giving up.

HG Short/Long Setups

Photograph provided by shutterstock.com

Wrap Up

With copper carving out a very wide range, there is ample opportunity to take some $$$ out of the range. We have provided a few trade ideas – one long and two short. There is another idea – wait for sell divergences to form on the hourly charts – this can be another trigger to get into a swing move back to the lower end of the range.

Tiny time-frame players scalping intraday should be looking to work the market from the short side. But, because the hourly and daily charts are all in up-trends you would want to be very careful and very nimble!

PS: don’t forget – if you have questions about the techniques used in this article, a simple 1 hour technical analysis coaching session can get all your questions answered!