Master Day Trading in Just 30 Days: Lesson #3

03

Lesson #3

In this 3rd installment of our day trading training series, we will briefly switch to something a bit more practical instead of just lecturing on the basics. One of the reasons we’re throwing this practical portion in here is because it might take you a few days to complete. We will jump back into more theory in the next lesson.

If you are a beginner, it is important that you get this done, even though it will most likely bore you to tears. A side benefit of this exercise is that it is the perfect preparation for the realization you will eventually arrive at after you’ve been trading for a while — the realization that the act of trading itself is very boring, and that it’s the hunt for the right trade that can be more stimulating.

Practical Overview

Your goal for this practical portion of the class is to execute 100 trades on your simulator over the next week or so. By doing this you will accomplish the following:

- Increase your comfort level with your selected trading platform.

- Learn to quickly enter different types of orders, without having to stop and think about how to do it and what it means.

- Start on the road to mastering looking at the charts, while simultaneously executing a trade.

- Start to internalize the rhythms of a single market.

We will help you set up your environment for this practical in this lesson and then discuss the actual trades to be used in lesson #4 (the next lesson). We will provide a chart layout and discuss the types of trades you should make including entry, exit and stops. These will be PRACTICE trades in your trading SIMULATOR, with the goal of achieving the four items outlined above.

However, before we explain how you will go about completing this practicum, let us start with an explanation of the four primary order types that you will be working with.

The Four Basic Order Types

Regardless of whether you are trading stocks, futures, or Forex, there are four basic order types that we find ourselves using on a regular basis.

Market Orders: This is the most common order type. It allows you to get in and out of your trades immediately at the current bid/offers. There was a time when we would hesitate to use market orders because of liquidity issues, but we’ve found that these days, in most large cap stocks and liquid futures markets, using market orders don’t really cost you that much in slippage, especially if you’re targeting a larger profit than just a quick scalp.

Limit Orders: This order type allows you to set a price at which you want to buy or sell. If you’re patient and you choose the correct price levels you can wait until the market gets to your price. Obviously, the disadvantage is that you might not get your order filled at all. Or, sometimes, you might only get part of it filled.

To enter a buy limit order, you would place the order BELOW the current market price. To enter a sell limit order you would place the order ABOVE the current market price.

For example, if IBM is currently trading at $100.00 per share, you can enter a buy limit at $99.00 per share. In this situation, you are hoping that price pulls back a little so you can get your trade on at a more advantageous price. (Of course, that doesn’t mean that if price pulls back to $99.00 it wouldn’t continue to fall — your limit order gives you no control over that situation.)

You can simulate a market order using limit orders by setting a limit above the current price if you’re looking to buy, or enter a limit order below the current price if you’re looking to sell. By doing this, you can also control the maximum price you would pay, which is not something you can do with a true market order.

Stop (AKA Stop-Market) orders: Stop orders allow you to enter or exit a trade as price moves in a particular direction. It can be considered the opposite of limit orders. To enter a buy stop order, you place the order ABOVE the current market price. Compare this to a buy limit, which is placed BELOW the market price. To execute a sell stop order, you place the order BELOW the current market price.

For example, if IBM is currently trading at $100.00 per share, you can enter a buy stop order to execute at $101.00 per share. When price hits or exceeds that level, the order automatically gets converted to a market order and the trade executes at the prevailing market price.

If IBM is currently trading at $100.00 per share, you can enter a sell stop order to execute at $99.00 per share. When price falls to or below this level, the order automatically gets converted to a market order and the trade executes at the prevailing market price.

The drawback with stop-market orders is that you have no control over the final price. This is especially true in the stock market where the market is generally closed at night. Many stocks can gap up or down the next day and thereby blow through your stop level. For example, if you had a stop-market order to sell IBM at $99.00 per share you might wake up to find that it opened at a price below $99.00. Maybe it opened at $90.00 instead. At that point, your stop-market order would execute and you would be filled at $90.00 or less. This may or may not be what you wanted.

Stop orders are typically used to initiate breakout trades or to exit existing trades.

For example, assume that you own IBM at $100.00 per share. Because of your chart-reading skills, you know that if price drops below $95.00, that it would most likely be going a lot lower, so you decide that you want out of the trade at that level. To make this happen, you would enter a stop-market order to sell at $95.00 per share or below.

Here is another example — assume that you recognize that IBM is in a trading range, and you decide that once it breaks out of that trading range, it would be a good time to buy because there is a good chance it would be headed higher. Then you can enter a stop-market order to buy above the trading range — say, $105.00 per share. After price rallies to that level, the order will be executed at whatever the prevailing price is at that time (usually $105 or greater).

As mentioned above, with stop-market orders, you have no control over the price at which your trade executes. Thus, most traders use this next order type instead of stop-market orders.

Stop-Limit Orders: A stop limit order is similar to a stop-market order, except that when the price level is reached, the order gets converted to a LIMIT order at the limit price you specify. In this way, you can control the maximum price at which you will buy or sell. As with limit orders, there is no guarantee you will get filled within the constraints of your limit, especially with large gaps.

For example, assume once again that you own IBM at $100.00 per share. And, because of your chart-reading skills, you know that if price drops below 95.00, that it would most likely be going a lot lower, so you decide that you want out of the trade at that level. To make this happen, you would enter a stop-limit order to sell at $95.00 per share STOP with a LIMIT at $94.00 per share. If price drops to $95.00 per share, the order would convert to a limit order to sell at $94.00 per share. Of course, since $94.00 per share is below $95.00 the order acts like a market order. As long as price stays above $94.00 the order will execute. If price falls below $94.00, then the order will not execute and you will be stuck with your shares of IBM.

The question that many beginning traders ask is “how can price fall below $94.00 without first trading at $95.00?” The answer is large opening gaps. Let’s say that IBM had an earnings report that the market did not like. The next day, the stock can open at $92.00 without ever trading at $95.00. This occurs because there are an overwhelming number of sellers that want out and the buyers know this so they will bid for the shares as low as possible. In this case, that might be $92.00.

Practice Time.

Photograph provided by shutterstock.com

Your Practical Homework – Part 1

The first thing you would need to do is to learn how to enter these four order types on your trading platform. Please remember to use your broker’s or software vendor’s SIMULATOR for this practical — you do NOT want to be using live orders for this homework.

Each software platform is different, and so the actual mechanics of entering these orders into your particular trading platform is not something that we can cover in detail here. However, we have included some links to training videos for four of the more popular brokers (these links are NOT affiliate links — we do not get compensated if you click them). Please review the videos for your trading platform and any other training materials that came with it. You only need to enter a few practice trades in your simulator right now — just enough to make sure you know how to enter the four order types.

Tradestation

Here is a video on how to enter these order types using the Tradestation ORDER BAR (basically their version of an order ticket): Order Bar — Placing Market, Limit and Stop Orders

However, we recommend that you use their MATRIX (aka their Ladder): Matrix — Placing Market, Limit and Stop Orders

Interactive Brokers

e-Trade

Unfortunately, e-Trade has all their tutorials in one video so we can’t provide separate links directly to the relevant tutorial.

Once you click the link, look at the top of the video and you will see clickable links that allow you to quickly navigate through the different sections.

Fidelity

We could not find an appropriate set of videos to link to here. Therefore, you will have to contact them directly or read their user manual to learn how to enter these types of orders.

“Regardless of whether you are trading stocks, futures, or Forex, there are four basic order types that we find ourselves using on a regular basis.”

Computer Components.

Photograph provided by shutterstock.om

Your Practical Homework – Part 2

Now that you have learned how to enter the four key order types in your trading platform, it is time to set up a basic chart that you will be using to practice entering and exiting orders based on these order types.

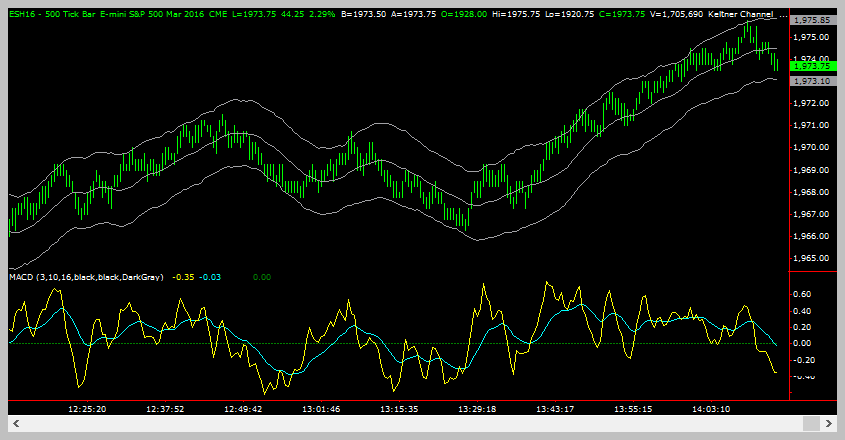

Create a chart with the following characteristics:

- Symbol: e-mini S&P futures contract usually trading under a symbol such as ESH16. Use the contract with the most daily volume!

- Timeframe: 500 tick.

- Add the “Keltner Channel” indicator overlay to your price panel.

- Set the ATR parameter to 2.5 and the moving average length to 20.

- In Tradestation the ATR parameter is called “NumATRs” and the moving average length is called “Length”. Other software platforms might refer to these parameters using different names.

- Add the MACD indicator to a panel beneath your price panel.

- Set the “Fast Length” parameter to 3

- Set the “Slow Length” parameter to 10

- Set the “Macd Length” parameter 16

- These parameters will be referred to by different names in different software and trading platforms.

When you are finished, your chart should look similar to the following:

The gray bands in the upper panel are the Keltner Channels and the yellow and blue bands in the lower panel are part of the MACD indicator. The colors of these items will vary depending on your charting software. The trading and charting software that we use (Tradestation) gives us the capability to change the colors on these indicators; we have chosen the ones you see in the chart above.

Under normal circumstances, we do not encourage the use of these types of indicators. But since we haven’t got to the point in our lesson series where we cover chart reading, we are using these indicators instead to help you practice entering and exiting orders while looking at charts.

For the purposes of this lesson, please make sure your chart and your order-entry system (either your ladder/matrix or order entry ticket) are side-by-side on your screen to make it easier to enter orders.

Need Help Setting This Up On Tradestation?

Sometimes its just easier to get someone else to set up your charts for you or maybe you just need clarification on the process or exercise. See how much you can get accomplished in one hour with a 60 min 1-on-1 coaching session!

Financial Instruments

Photograph provided by canstockphoto.com

Terminology

Here are the terminology items for this lessson.

GTC: This is an acronym for “Good Till Canceled”. It means that the order remains in the broker’s system even after the markets are closed. Then, it is automatically re-entered the next day without any action on your part. The order remains active every day until you cancel it or until the time limit that the broker sets expires. Most brokers will automatically expire any unexecuted GTC orders after six months.

GTC orders can usually be attached to STOP-MARKET, LIMIT and STOP-LIMIT orders. It is also (usually) available for other less-standard order types.

OCO: This is an acronym for “One-Cancels-Other”. This type of order allows you to enter two orders that are linked to each other. When one order gets executed the other is automatically canceled. You can use this type of order for breakout trades where you have no idea which direction the breakout will occur. Or you can use it for exit orders where you have a target limit order and a protective stop-loss order.

OSO: This is an acronym for “One-Send-Other”. This type of order allows you to automatically send a new order when an existing order is executed. For example, you can create an OSO order to enter a long position at a limit price and, if filled, automatically send a protective stop-loss order and/or a target/profit-taking limit order.

DAY: This refers to the duration of most orders. Most orders entered into a brokers system are “day” orders. At the end of the day, they are cancelled if not filled. If you do not wish to have your order canceled at the end of the trading day, make sure you use a GTC order. We use GTC orders for most of our protective stop-loss orders.

Wrap Up

In this lesson, we introduced the basic types of orders you will be using to create trades. We also provided some homework related to setting up your trading platform and a single chart. We will use the chart in the next lesson, where we will describe the types of practice trades you should initiate.

We know that you want to get to some actual trading, so our next few lessons will focus on setting you up to practice entering and exiting orders. After that, we will get back to more theory, including covering the basics of FOREX.

Coming Up Next

- Increase your comfort level with your trading platform

- Practical: Entering Market Orders

Later

- Market structure as shown on charts and how that helps your profitability

- Defining legs and swings on the charts, which will help the precision timing of your trade entries and exits

- All about trend reversals, so you can enter new trends early

- Exercises to practice scalping and intraday trades, which will contribute to your cash flow and smooth out your equity curve

Edit History

03-03-2016: Edited to clarify that the contract with the most volume should be used instead of trying to use ESH16 after it has expired.