Pattern: Bonds At Support – Long Scalp Trade Opportunity

02

November, 2016

30 Year Bond Futures traded on the CME have pushed into a strong support area and has spent the last few days trading in that zone. We believe that this sets up a long scalp opportunity.

Why just a scalp? Well, read on and see…

This market is officially in a DOWN-TREND. The cross-current is that the TLT (an ETF) has a “power-buy” configuration. It is for this reason why we’re only recommending a SCALP trade.

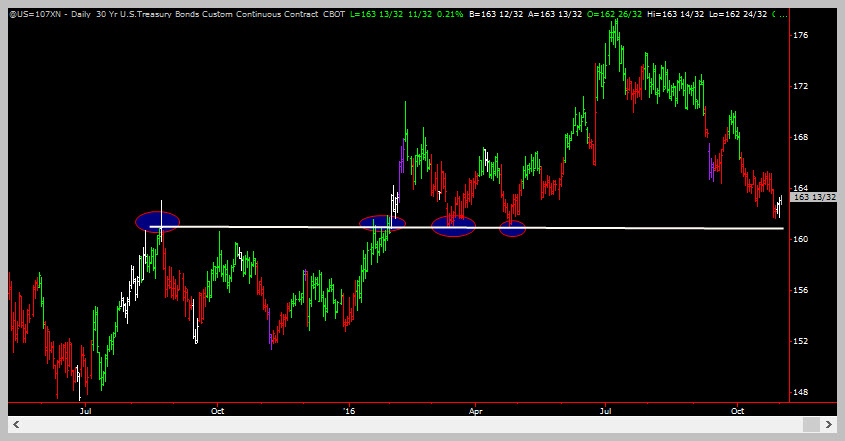

First, lets take a look at the 30 year bond futures chart (Symbol USZ16 or ZBZ16 on most trading platforms.) The white horizontal line marks the strong support area – you can see the four touch points. 2 of them were prior resistance that were subsequently broken and therefore became support, and two of them are old support levels that have not broken (yet).

Now, lets take a look at the TLT ETF chart (shown below). The blue area is support and the white “zig-zag” lines is the powerbuy formation.

How To Construct The Long Trade

The long trade construction is very simple.

Entry: Buy at the market

Target: Whatever level price is when your favorite short term oscillator on the daily chart is overbought.

Protective Stop: Futures – below 160. TLT – Below 126.

The protective stop is wide so that you stay out of the noise. As we get closer to US elections you will see more volatility and you want to not get tagged in it. In fact, I would say that you should wait for a CLOSE below 160 (futures) or 125 (TLT) before triggering yourself out of the trade but you might need some cast-iron stomach and a healthy trading account in order to do that.

Bonds Are A Potential Long Trade

Photograph provided by shutterstock.com

Wrap Up

Long term US bonds are in a downtrend but holding major support. This presents a long trade opportunity – as long as you have a protective stop outside the potential volatility

PS: don’t forget – if you have questions about the techniques used in this article, a simple 1 hour technical analysis coaching session can get all your questions answered!