Pattern: ES Hourly Consolidation – What Are Your Trading Options?

27

OCTOBER, 2016

Earlier this week, the e-Mini S&P contract (ES) formed an hourly trend reversal from DOWN to UP. However, that was done in the context of a much larger consolidation pattern.

Obviously market participants in the US are taking a wait-and-see attitude towards the election results due in about 2 weeks. But, as traders, it is our job to develop risk-adjusted scenarios so we can be prepared for whatever happens.

Unlike many of our articles and ideas that we publish, this particular article is not going to discuss concrete entries, exits and stops – instead it will set up three scenarios and outline how you can play each of them them. We will most likely be issuing new alerts and articles as one or more scenarios start to manifest themselves – those will contain concrete entry and exit ideas.

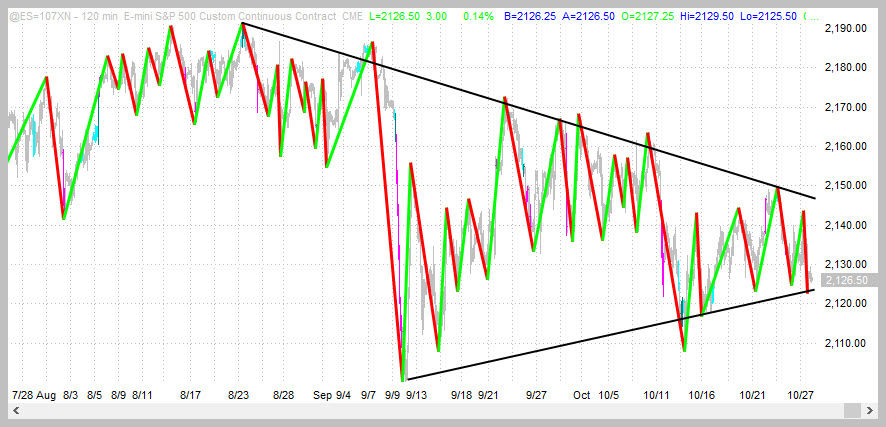

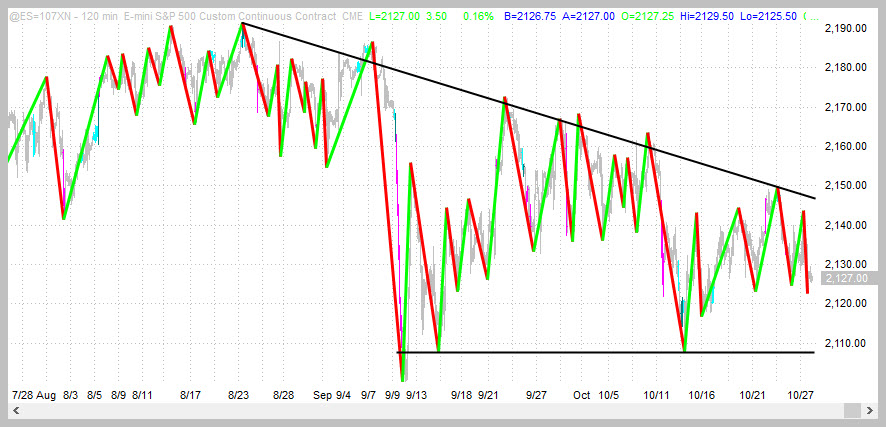

To get started lets take a look at the 120 minute chart of the ES. There are multiple ways we can draw the consolidation trend lines. Two possible ways are shown in the charts below – the black lines are the boundaries of the consolidations.

We prefer having at least one trend line being horizontal so we are partial to the second chart above and is the one we’ll be working with in this article.

What Are The Possible Trading Opportunities?

There are many possible outcomes, each with a different trading strategy. Keep in mind that the overall market is still in an uptrend on all timeframes – so long trade setups can be traded more aggressively. Short ones should be treated as scalps.

Trading Idea #1

In the short term (basically before the election), any further move towards the lower end of the range will set up long trades. So you should be looking for buy divergences on hourly charts as price moves lower.

Keep in mind that the price action will probably feel very scary as that move lower occurs. Don’t panic – those lower boundaries are strong support.

If you make the trade and price CLOSES below the lower boundary then you should consider exiting the trade and take the loss. But be prepared to re-enter if price moves back inside the boundary lines.

Trading Idea #2

Don’t feel like sitting in front of the computer every day? This idea allows you to put on a trade that has potential for profit no matter the outcome of the election.

Whoops, this idea is for paid members only – we can’t give away everything for free now. If you have a membership, please log in. If not, you can definitely get access!

Trading Idea #3 and #4

A consolidation must eventually break – either to the upside or downside. You can simply wait for one of the boundries to be broken. And it is likely to be broken just after the election – there is just too much pent up volume inside this range.

(To manage breakout trades properly, you can read The Only Trading Technique You Will Ever Learn which covers everything we know about breakout trades. Members, please check your account dashboard for a link to this book.)

A solid break of the lower boundry has potential for a quick 50-100 point move lower. The short side is not as far-fetched as you might think. There are enough data points slowly accruing to keep that idea on the board. The Nasdaq for example probably the strongest index, had a false upside breakout this week which is generally a weak sign.

However, we are biased to the long side because all timeframes are STILL in uptrends. So even though price is at the lower end of the range and has to move up 30+ points to even begin an upside breakout, we’re still thinking of sticking with the trend (but always looking for signs that we could be wrong.)

Breakouts – Bulls & Bears Battle

Photograph provided by shutterstock.com

Wrap Up

The US stock market is just ping-ponging between two trend lines as it waits for election results. But you can start gaming various scenarios to be prepared regardless of the outcome.

A good exercise is to create a spreadsheet with as many chart outcomes as you think are possible and decide how you would trade each of them. Sometimes, just being prepared is the best trade you can make.

PS: If you’re reading this on our website then consider signing up for our emails. We will push these kinds of short, succint, actionable articles directly to your inbox.