The Simplest Trade You Could Make All Year

28

November, 2016

Sometimes its best to just keep things simple.

We mentioned last week that US Equities generally have a bullish bias during the Thanksgiving holiday week and that if a breakout were to occur, there was a good chance it would be during that time period.

And a breakout is what we got. All signs are that it is real. And so we should continue to respect that price action.

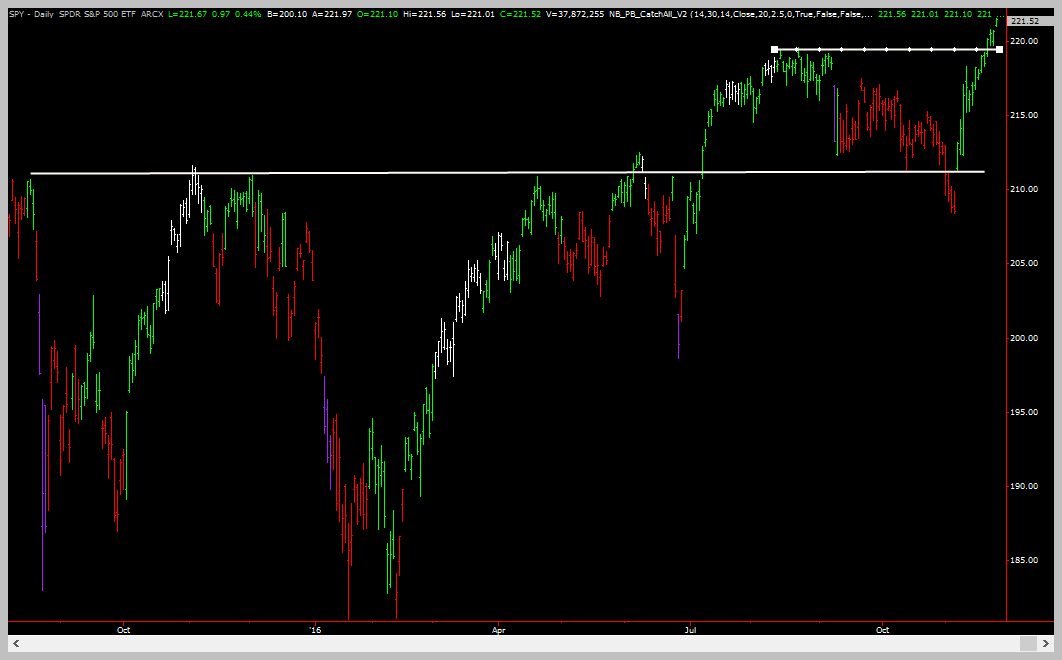

Here is what the breakout looks like as of Sunday night – on a daily chart…

It doesn’t look like much, right? The right hand side looks like a breakout that can run for 8 SPY points. Not bad but some would whine that its “only” a tiny 3.5% potential move.

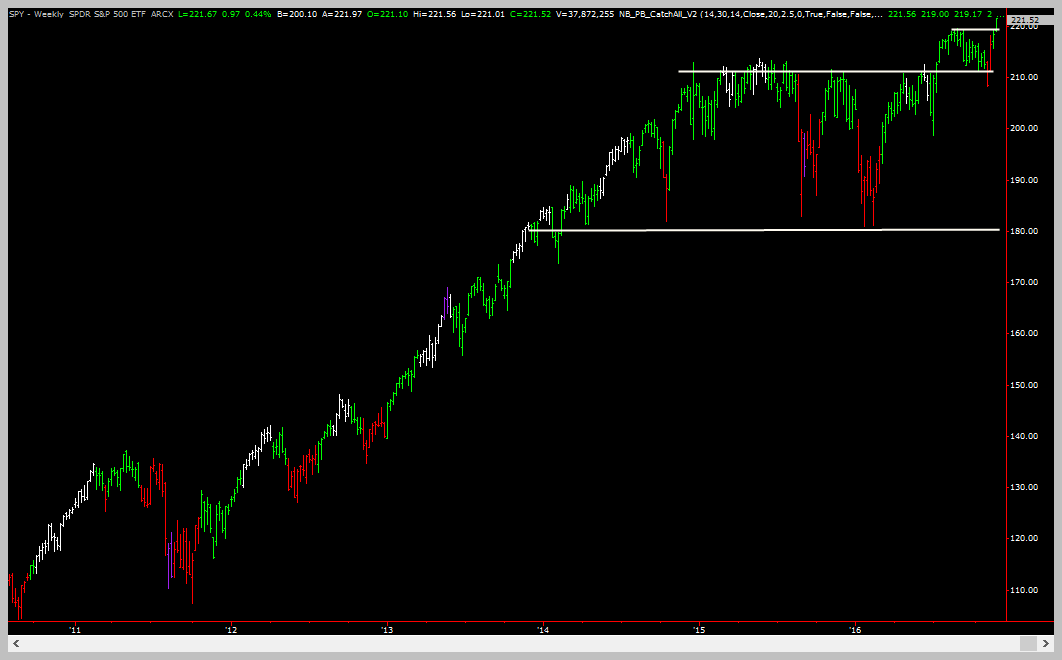

Ummm…not so fast. Lets look at the weekly chart…

The latest breakout is in the context of a much larger breakout that occured earlier this year. Then, the market broke out, and retested its breakout point – flushing out weak longs on the night of the US elections. (Retesting a breakout point is a common occurence – the trick is to get positioned after the retest. )

There is still a good 10% upside potential left in order to meet even just the FIRST level objective of the major weekly breakout!

So, the latest mini-breakout is the perfect way to structure a lower-risk trade with the idea that you’re shooting for the much larger target shown on the weekly breakout chart.

Sometimes, the simplest trade is also the hardest one to take. You might think you missed the boat but the charts suggest that the move is still in its infancy!

The KISS TRADE (KISS = Keep It Simple Stupid)

Entry #1: Buy ANY red swing on the hourly charts.

Target: At least 8 SPY points from Friday’s close.

Protective Stop: Either an hourly swing low if you’d like to play it tight or 218.00.

Seriously, that is the trade – just buy pullbacks. You have the weekly chart pattern, the daily smaller breakout and the DECEMBER bullish bias all in your favor. This is the trade to make going into the end of the year. Could it fail? Sure, but your job is to play the odds, especially when it starts to line up aggressively in your favor!

Answer To A “You guys aren’t so smart” Question/Comment

We’ve gotten the equivalent of this recently: “But guys, you told us just a couple of weeks ago to take half of our long position off. Weren’t you wrong then? Why should we trust you now?”

We weren’t wrong then. It was the RIGHT thing to do. Price was at a resistance point and it could either go through or fall all the way back. The PRUDENT thing to do was to take some of your exposure off the table. AND, if we get the breakout (which we did), then jump back in as we suggested.

Part of good (aka professional) trading is always having a plan and understanding when you’re at a point of maximum opportunity or maximum danger or both! You have a lot of skills that need to be developed – this is just one of many.

ES/SPY Bullish Bias – KISS

Photograph provided by shutterstock.com

Wrap Up

Simple: Buy hourly pullbacks on the SPY/ES/DOW/TF/EMD. You have a choice of two stop levels depending on how aggressive or conservative you would like to be.

Seriously, the odds are that this is the time to KISS things – even if the trade gets stopped out we will not beat our selves up for taking it. It really is the right thing to do!

PS: don’t forget – if you have questions about the techniques used in this article, a simple 1 hour technical analysis coaching session can get all your questions answered!