Trade Idea: SPY and ES – First Hourly Pullback After Trend Reversal

25

OCTOBER, 2016

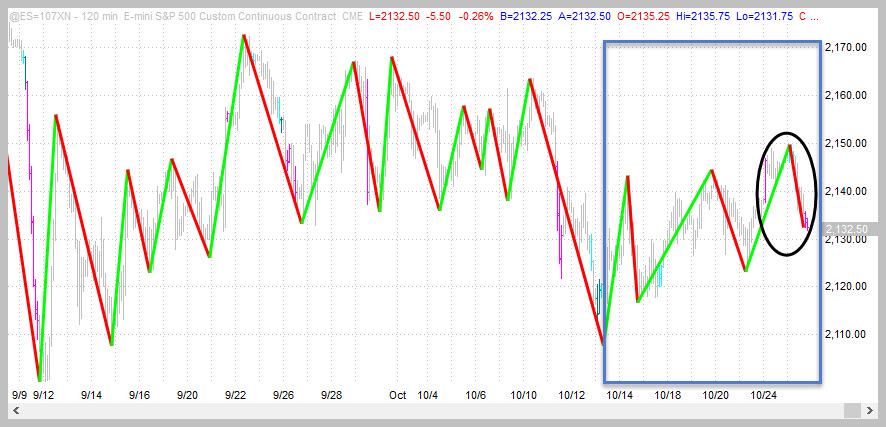

Earlier this week, the e-Mini S&P contract (ES) formed an hourly trend reversal from DOWN to UP. Today, the first pullback occured thereby setting up a potential trade.

Lets take a look at the charts and see what could potentially trigger a trade.

The chart above is a 120 Min chart of the ES. The blue box shows the hourly trend reversal that was occuring over the last couple of weeks and that finalized on Sunday night. The black circle on the right is the first pullback that occured today.

What Are The Possible Trading Opportunities?

All trading opportunities are going to be LONG trades since all higher timeframes are also in uptrends. Its a really bad idea to try go be shorting when so many large time-frames are in uptrends.

Trading Idea #1

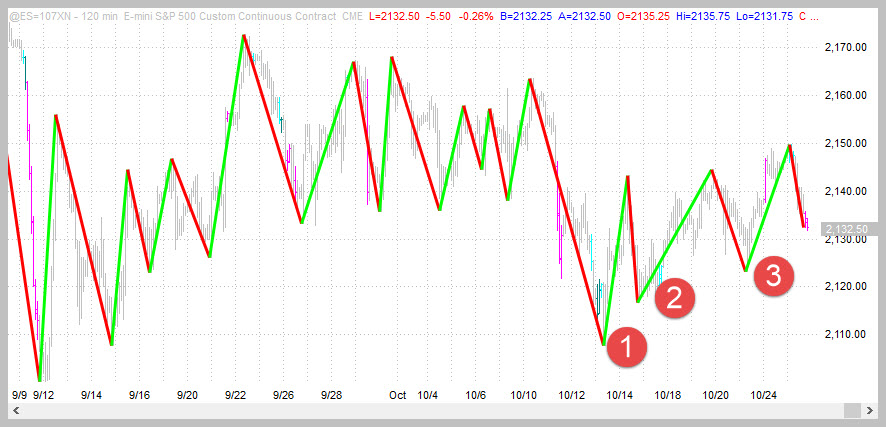

- Entry: Buy now

- Protective Stop: Below the last pivot – around 2122 (shown in the chart below at point 3). If you like to give your trades more room to develop or simply hate getting whipped out of your trades you can set your stop to below point 1.

- First target and exit: New All Time Highs

- Second target and exit: A full 10% move from current prices

Trading Idea #2

- Entry: Buy when the swing turns green again

- Protective Stop: Below the last pivot that forms at the point

- First target and exit: New All Time Highs

- Second target and exit: A full 10% move from current prices

Don’t like the above entry methods? Here are two additional triggers you can use:

- Wait for buy divergences on the 60 min or 120 min charts. The danger with this is that they might form overnight so you’ll be chasing price when you wake up.

- Buy when you see a trend change UP on an ultra-short time-frame. I favor the 350 tick ES chart for this – the stop would then be about 5 ES points on a normal volatility day.

Bulls On Parade!

Photograph provided by shutterstock.com

Wrap Up

The first pull back after a trend reversal is always a great opportunity for at least a scalp trade. The trade ideas above actually encourage you to hold on for a bigger win – these kinds of longer term trades have 40%-50% win rate. Scalp trades though, could have as high as an 80%-90% win rate when trading the first pullback after a trend reversal.

PS: If you’re reading this on our website then consider signing up for our emails. We will push these kinds of short, succint articles directly to your inbox.