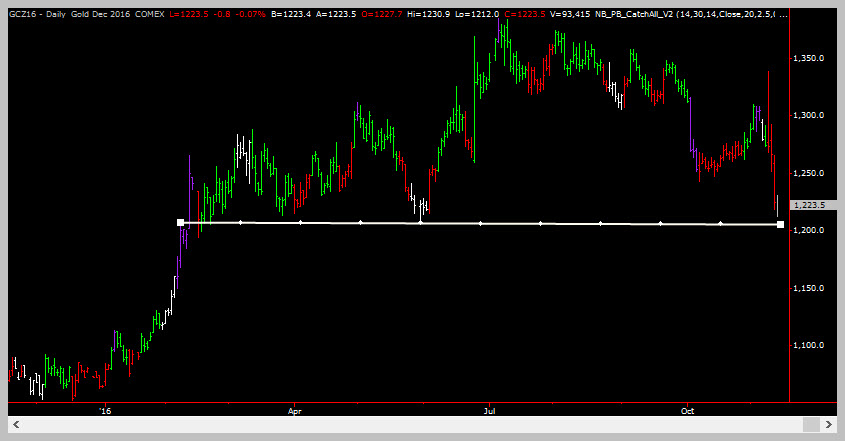

Gold Market At Support – Long Swing Trade Idea

14

November, 2016

Gold is in a down-trend on the daily charts. BUT, it is now into an area of strong support which means that day-traders and even swing-traders can probably start to make trades to the long side.

Yes, we know, the sell-off has been brutal but sometimes it is OK to play oversold markets that are in a down-trend. We believe that this is one of those times that we can go AGAINST the prevailing trend.

As with all things trading related though – risk control is the key to not getting your head handed to you. No matter how good the set-up and how favorable the conditions, you should know how to size your trade and where you will get out in order to protect your capital. (Yes, we know you’ve probably heard this message a ton but we’ll keep harping on it anyway!)

Ok, lets look at the daily chart of gold futures traded on the CME – December 2016 contract now…

If you look to the left of the chart you can see the large amount of turnover that occured around this level and you can see that price made multiple attempts to dip below this level. So maybe gold will flush a little lower to test the 1200 level but somewhere in here is a nice long trade to be made – there is just too much volume that exchanged hands in this area to not expect some sort of bounce or trading range to develop.

So, here are THREE trading ideas suitable for different time frames and risk profiles…

Trade Idea #1

Buy at the market – as usual, this is the most aggressive option.

Entry: Buy at the market.

Exit: Exit 50% of your position when your favorite SHORT TERM oscillator is half-way up to its over-bought area. At that time pull your stop to break-even

Protective Stop Order: Exit your position 3 ATRs below today’s low. This is a VERY wide stop – primarily because we can see a fake flush below 1200 where a lot of stop orders are positioned just waiting to be swept by the many computer algorithms fishing for them.

Trade Idea #2

Enter on a 15 minute pullback…

Entry: Enter at the market when the 15 min chart turns red and then turns green again.

Exit: Use a trailing stop 2 swing points back.

Protective Stop Order: Use a trailing stop 2 swing points back.

Note: Lesson #13 in our Master Day-trading in 30 days series covers trailing stop examples…

Gold At Support, Swing Trade Potential

Photograph provided by canstockphoto.com

Wrap Up

Gold is at a support area. It is likely to move up from here over the next few days so nibbling at long trades now is our best idea for this market. We expect that there are lots of stop-orders at the 1200 level (basis CME DEC 2016 contract) so a flush below that level is not out of the question. Since this is a COUNTER-TREND trade, you must use smaller size and play a defensive game!

PS: don’t forget – if you have questions about the techniques used in this article, a simple 1 hour technical analysis coaching session can get all your questions answered!