Description

What Does the Active Trader Really Want?

… other than the proverbial Holy Grail that prints money while they’re sitting on a beach sipping drinks with pretty umbrellas in them?

Kidding aside, this is the question we asked ourselves when approaching the content of this book. The truth is that after a little experience, all traders soon find that they need a way to impose a bit of structure on price action. They need a way of determining where to put stops, what price targets to shoot for, when to play for a small or large target, and how to trail a stop. They also need to know when to bet small and when to increase size.

Without a way of adding structure to the price action, traders flounder around getting whipped out of perfectly good trades by vicious price movements that are no more than corrective to the primary trend. Tiny movements in price take on greater meaning than they should. Without structure, it is harder to define risk and harder to optimize the use of leverage. The lack of a structured way of looking at the price action makes it harder to approach the markets in a consistent fashion. That, in turn, makes it almost impossible to be successful at trading in it.

What You Should Get from This Book

After reading this book you should be able to:

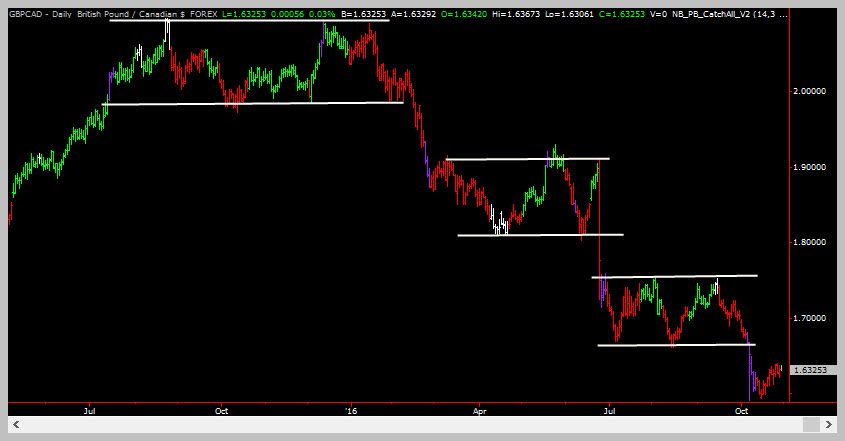

- Impose a general structure on any market

- Filter out “noise” to see the bigger picture

- Evaluate with certainty whether a market is in an uptrend, downtrend, or range/noise environment

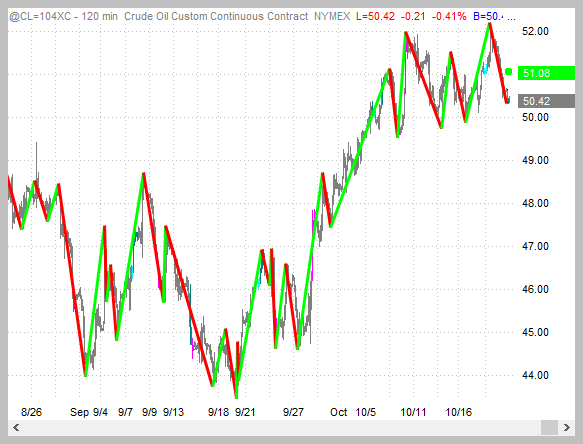

- Identify whether or not a particular trading opportunity is to be played for a scalp or held for a bigger win

- Objectively identify risk points

- Objectively trail a stop when playing for a larger win

- Effectively use multiple timeframe analysis

- Discard almost all indicators that are simply derivatives of price, and use pure price movement for trading

- Make better use of common price or indicator patterns when initiating or exiting trades

So go ahead an purchase this book – you will not regret it. And it will radically improve the way you view the markets!