Master Day Trading in Just 30 Days: Lesson #9

09

Lesson #9

The prior installment in this series introduced the idea of LEGS and SWINGS. But it left open the precise definition for the construction of these legs and swings. In order to do this now, you might want to refresh your memory on Average True Range — it was a definition term we provided in an earlier installment.

Precise Definition Of A Swing

An up-swing or up-leg starts when price has moved 2.5 ATRs (Average True Ranges) away from the lowest price low of the last sixteen bars. In other words, take the last 16 bars and find the lowest price. When price has moved 2.5 ATRs higher from that low, an upswing starts and you can start drawing upswing lines.

A down-swing or down-leg starts when price has moved 2.5 ATRs away from the highest price of the last sixteen bars.

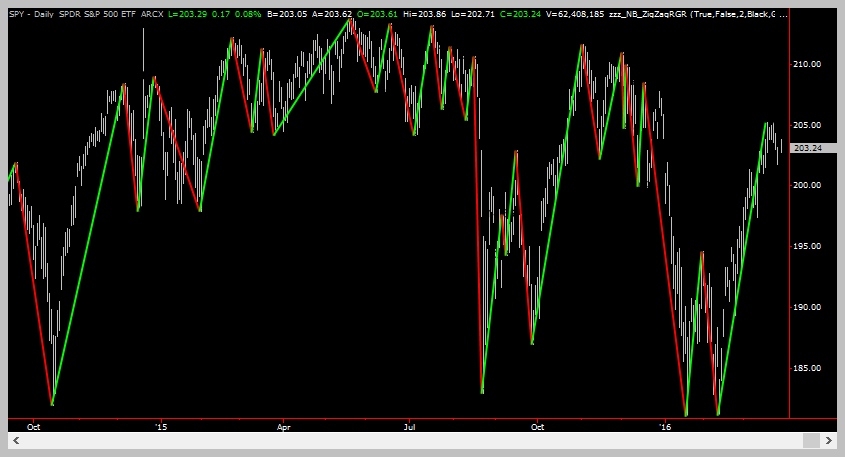

Following these rules, let’s see what the same chart from the last lesson would look like now:

Obviously we have colored the upswings green and the downswings red. You can see that it’s a much different picture than any of the charts we looked at in the last lesson. BUT, with the rules, anyone can draw the legs and get the SAME result!

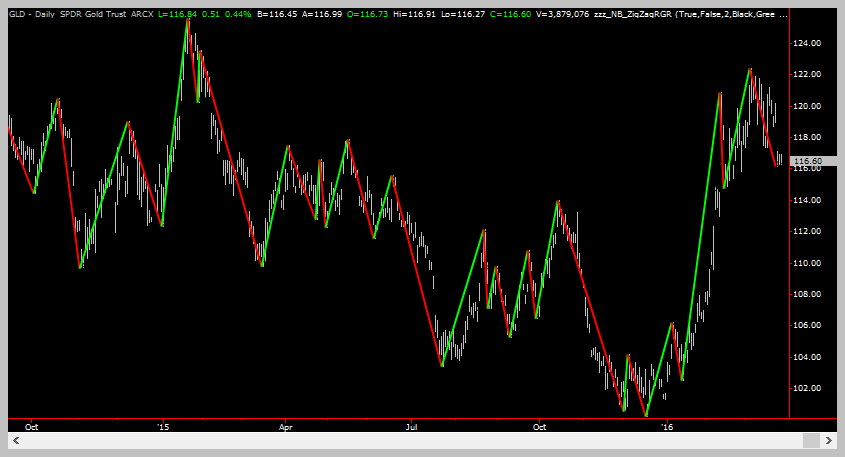

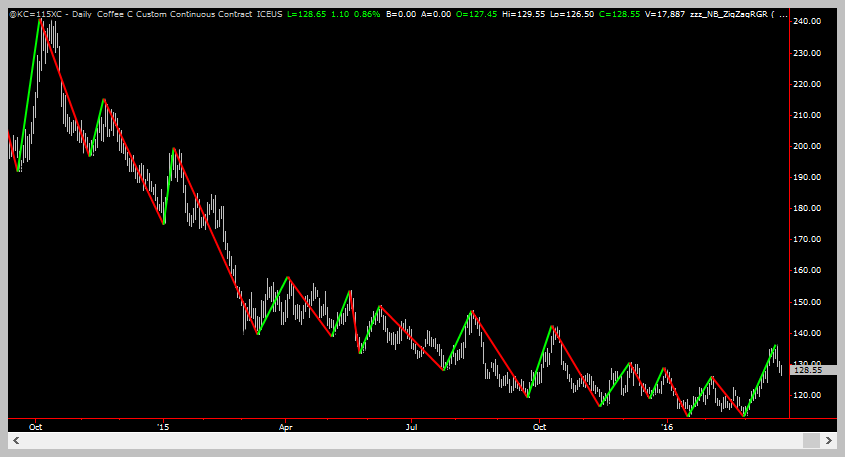

Let’s look at some examples from a couple of other charts:

The above is a chart of GLD. You can see the upside impulse from earlier in 2016. Our second example below is a chart of coffee.

On the chart above, do you notice price has pulled back from the recent high? However, it has not moved far enough below the recent highs for our rule to kick in, so we will continue to hold the up-swing line in place until price moves further up or further down low enough to trigger our downswing rule.

Maybe you have picked up on this already, but you can see that drawing these legs on the chart gives us a nice visual filter away from the random price movements on the individual bars. For trading purposes, in this series we are only concerned about these legs.

Sample Charts

Photograph provided by shutterstock.om

“An up-swing or up-leg starts when price has moved 2.5 ATRs (Average True Ranges) away from the lowest price low of the last sixteen bars. ”

Questions?

If you have questions about the contens of this (or any other) lesson, you can get 1-on-1 time with our head trader. Sometimes personal attention is just the ticket you need. See how much you can get accomplished in one hour with a 60 min 1-on-1 coaching session!

Homework

Drawing these lines by hand and doing the calculations manually to figure out the price level at which the swings will change direction is tedious. But you should at least try it a few times on a few charts. After that, you might be able to get an add-on program or plugin for your charting platform to draw them in automatically for you. So as part of this homework, you should contact the vendor of your charting software and ask them to help you create an automated tool/script/indicator to create these lines.

Terminology

Photograph provided by shutterstock.com

Terminology

There is only one new definition to learn in this lesson. Scalping is a term usually used to refer to very short term trading on an intraday basis. In a few lessons, you will be placing orders for your first scalp trade, so it is probably better for you to know what the term means now, since we will be using it extensively.

How do you feel after you have completed this exercise? Let us know by using our contact form! We would love to hear from you!

Wrap Up

This was another short lesson. In the next couple of lessons, we will show you how to use these swings and legs to identify the dominant trend. After that, we can really start to have some fun, as the lessons flip once again to more practical concerns.

Coming Up Next

- More “Legs”

- More “Leg” transitions

Later

- Market structure as shown on charts and how that helps your profitability

- All about trend reversals, so you can enter new trends early