The Forex Edition – Multiple Cross-rates Setting Up Tradeable Patterns

16

November, 2016

There are multiple cross-rates that are approaching support or resistance levels. Some of these are not what you would call the “majors” but they are tradeable nontheless.

Because there are multiple cross-rates this article will deviate from our usual format. Normally we pick a market and discuss it in some detail.

But we can’t do that with all of these cross-rates. So we’re going to show you the charts and provide the primary trade idea that we see. We’ll suggest a level where your protective stop order should initially reside but leave the rest of trade management up to you.

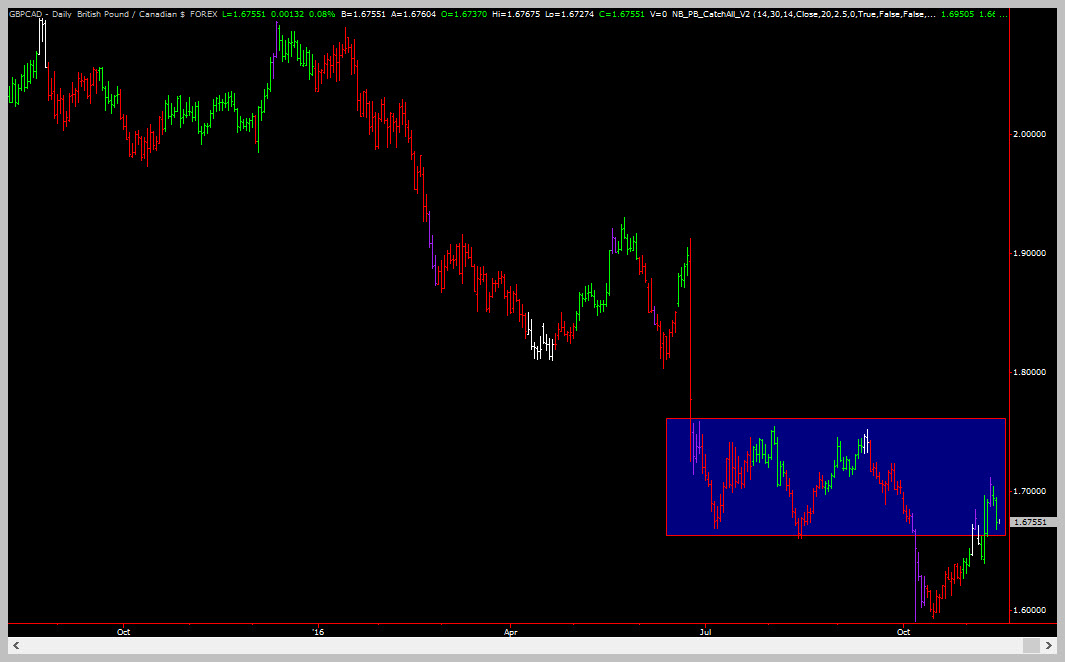

GBPCAD

Short Trade

- Market is in a down-trend

- Market is at resistance

- Most oscillators are overbought

- Short term oscillators are turning back down

Entry: Sell-short at the market.

Exit: Exit 50% of your position when your favorite SHORT TERM oscillator is half-way to its over-sold area. At that time pull your stop to break-even.

Protective Stop Order: Exit your position at 1.73 (yes, its a very side stop but remember, this is a daily time frame so average moves are larger!)

Chart images provided by Tradestation Charting Software

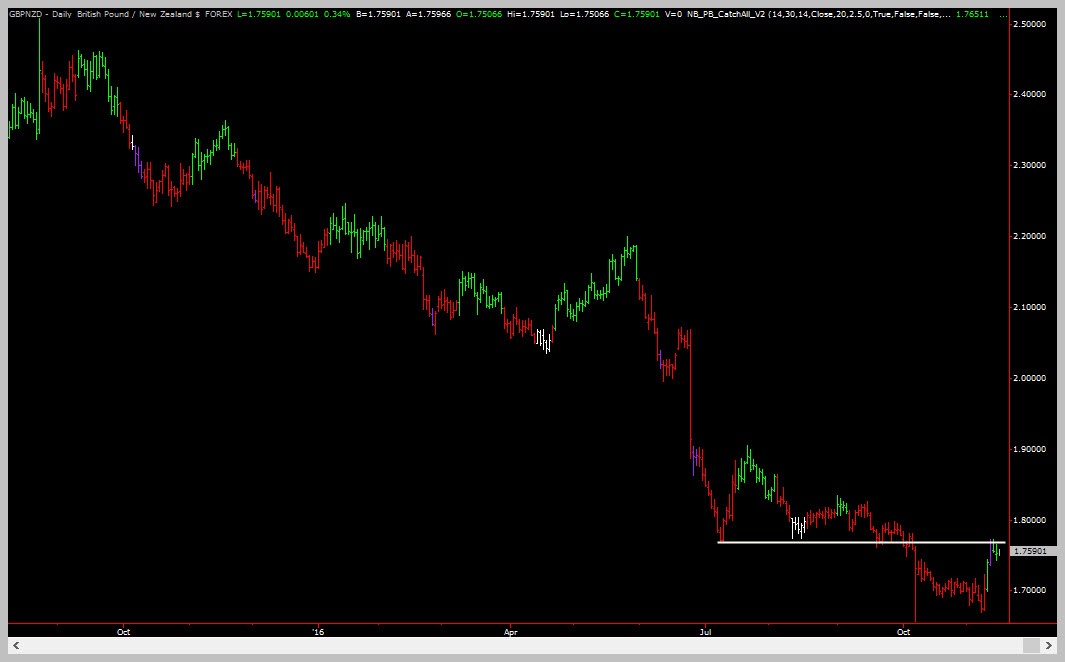

GBPNZD

Short Trade

- Market is in a down-trend

- Market is at resistance

- Most oscillators are overbought

- Short term oscillators are turning back down

Entry: Sell-short at the market.

Exit: Exit 50% of your position when your favorite SHORT TERM oscillator is half-way to its over-sold area. At that time pull your stop to break-even.

Protective Stop Order: Exit your position on a CLOSE at 1.80 or higher.

If you get stopped out, re-enter short on a close below 1.76 and try the trade one more time.

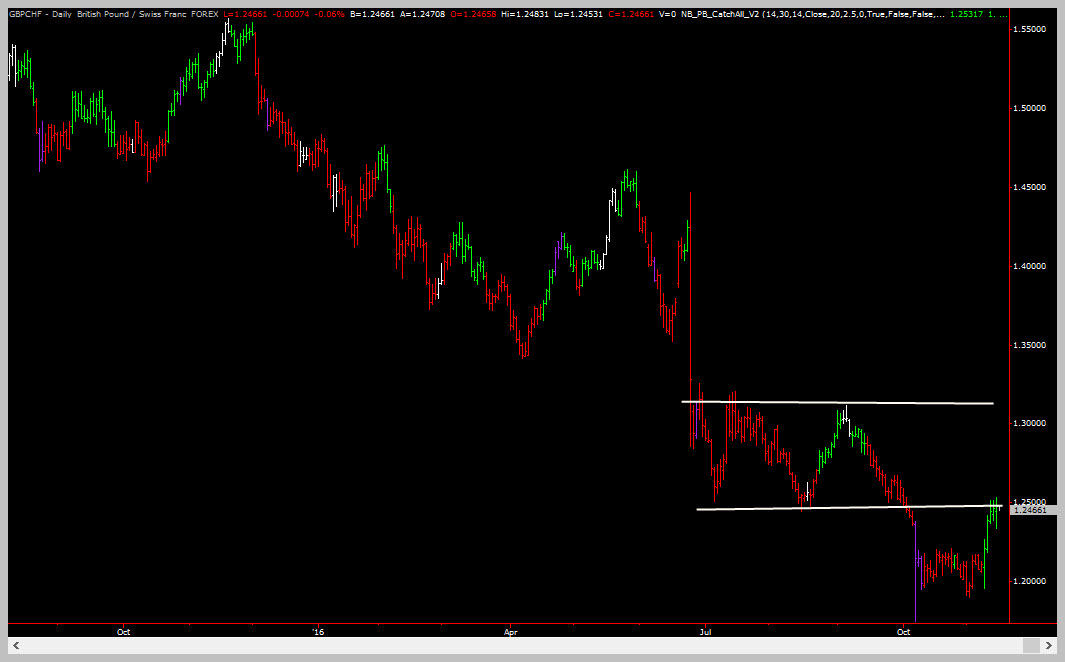

GBPCHF

Short Trade

- Market is in a down-trend

- Market is at resistance

- Most oscillators are overbought

- Short term oscillators are turning back down

Entry: Sell-short at the market.

Exit: Exit 50% of your position when your favorite SHORT TERM oscillator is half-way to its over-sold area. At that time pull your stop to break-even.

Protective Stop Order: Exit your position on a CLOSE at 1.30 or higher.

If you get stopped out, re-enter short on a close below 1.25 and try the trade one more time.

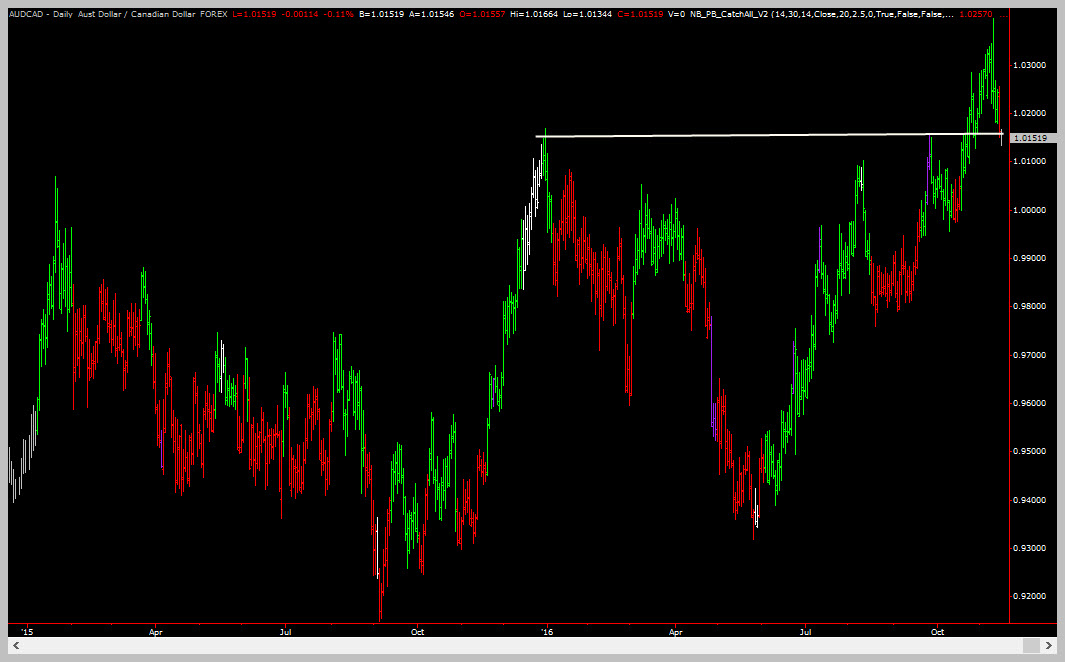

AUDCAD

Long Trade

- Market is in an up-trend (can you see why?)

- Market is at support

- Most oscillators are oversold

- Short term oscillators are turning back up.

Entry: Buy at the market.

Exit: Exit 50% of your position when your favorite SHORT TERM oscillator is half-way to its over-sold area. At that time pull your stop to break-even.

Protective Stop Order: Exit your position at 1.005.

Chart images provided by Tradestation Charting Software

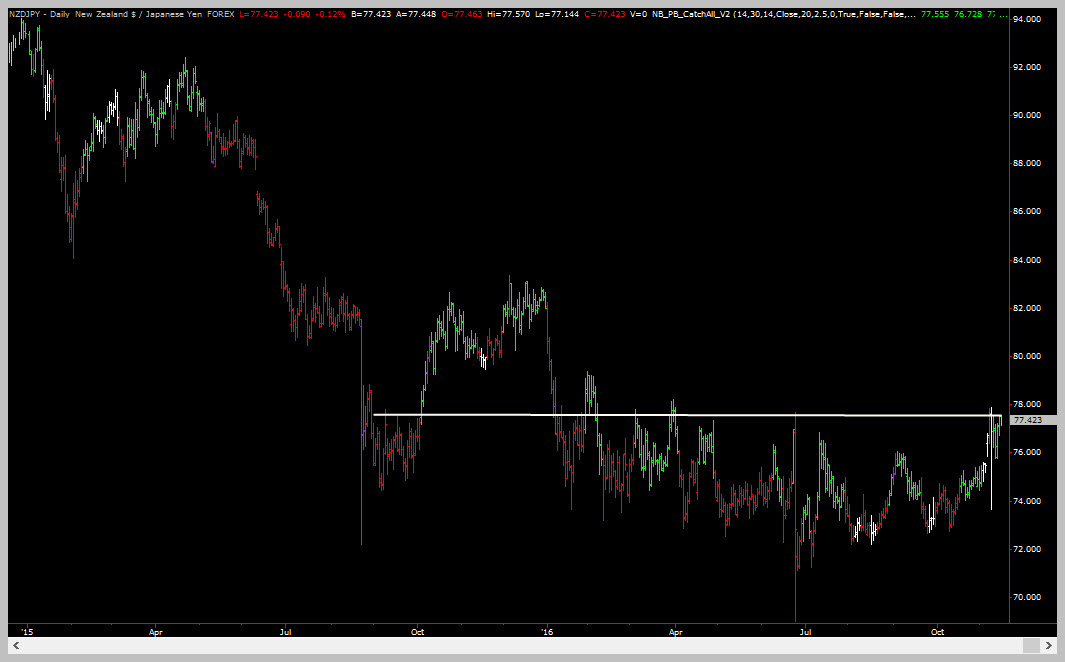

NZDJPY

Short Trade

- Market is in downtrend

- Market is at resistance and showing an (unconfirmed) power-sale structure.

- Most oscillators are overbought

- Short term oscillators are turning back down

Entry: Sell-short at the market.

Exit: Exit 50% of your position when your favorite SHORT TERM oscillator is half-way to its over-sold area. At that time pull your stop to break-even.

Protective Stop Order: Exit your position on a CLOSE at 79 or higher.

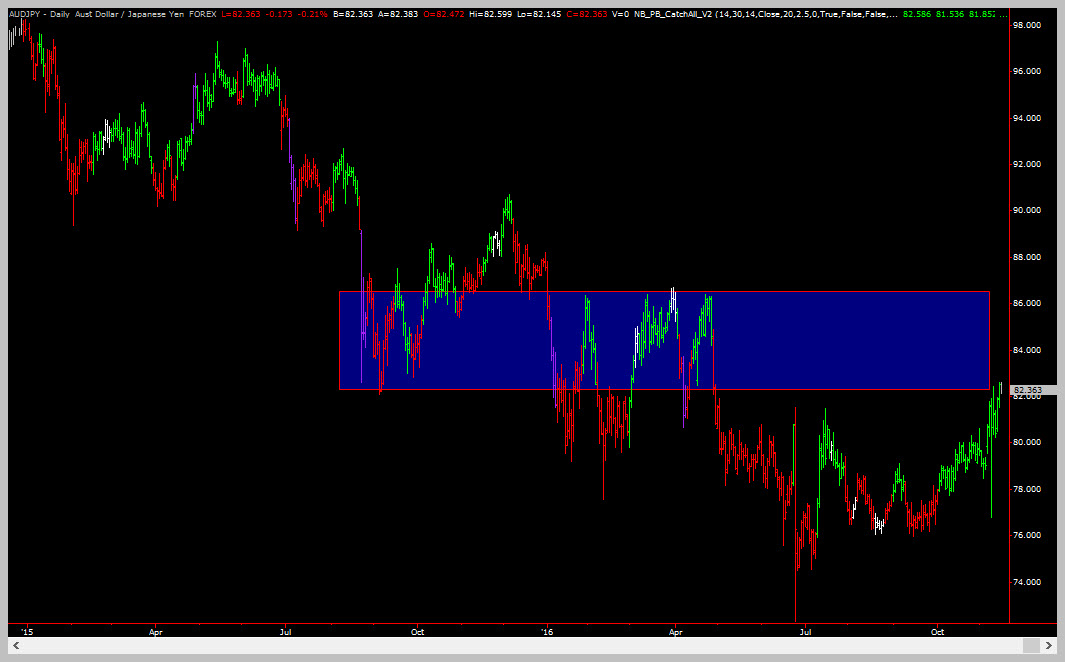

AUDJPY

Short Trade

- Market is in downtrend

- Market is at resistance and showing an (unconfirmed) power-sale structure.

- Most oscillators are overbought

- Short term oscillators are turning back down

Entry: Buy at the market.

Exit: Exit 50% of your position when your favorite SHORT TERM oscillator is half-way to its over-sold area. At that time pull your stop to break-even.

Protective Stop Order: Exit your position on a CLOSE at 84.00 or higher.

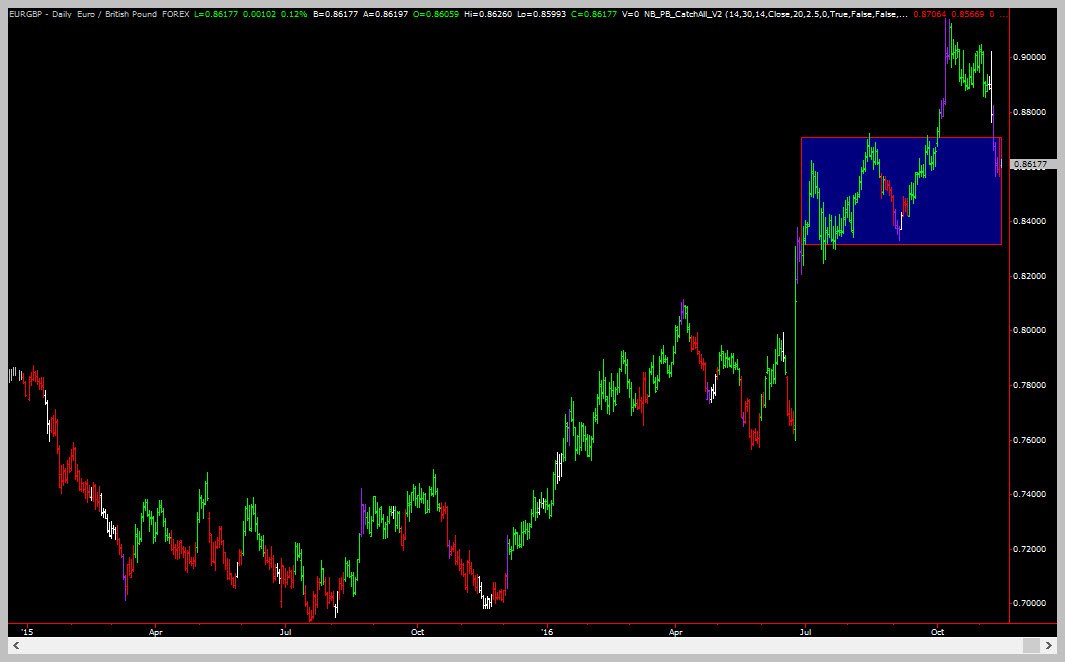

EURGBP

Long Trade

- Market is in an up-trend

- Market is at support

- Most oscillators are oversold

- Short term oscillators are turning back up.

Entry: Buy at the market.

Exit: Exit 50% of your position when your favorite SHORT TERM oscillator is half-way to its over-sold area. At that time pull your stop to break-even.

Protective Stop Order: Exit your position at 0.8200.

Chart images provided by Tradestation Charting Software

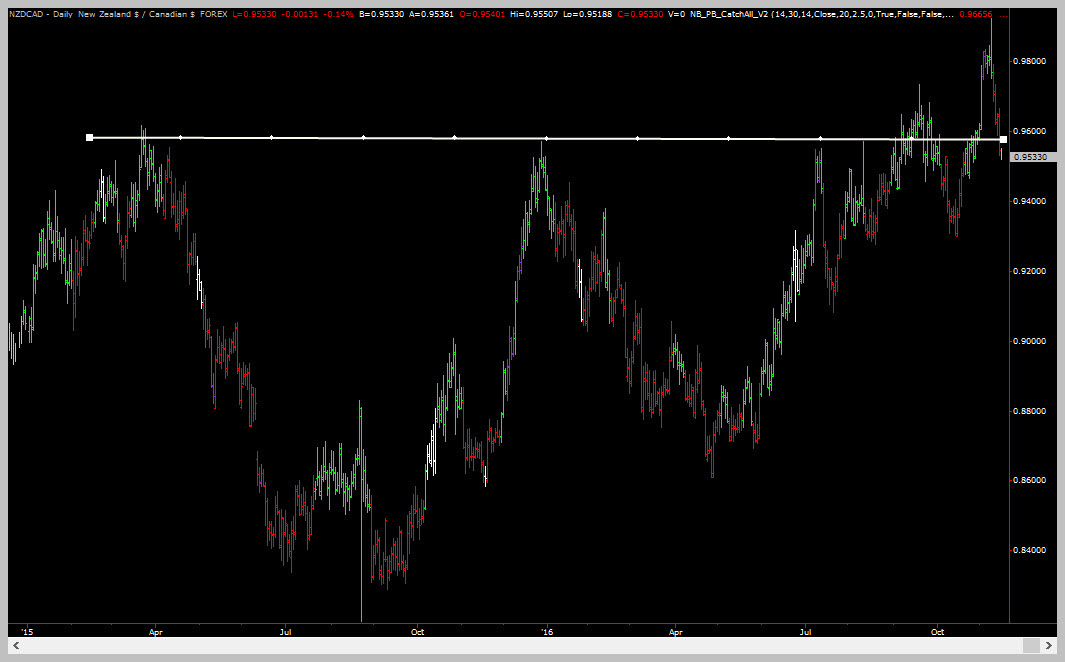

NZDCAD

Long Trade

- Market is in an up-trend

- Market is at support

- Most oscillators are oversold

- Short term oscillators are turning back up

Entry: Buy when the swing turns GREEN

Exit: Trail a 3 ATR stop

Protective Stop Order: Set an initial protective stop at the prior swing low created after the GREEN bar forms.

9 Forex Trades

Photograph provided by shutterstock.com

Wrap Up

We deviated from our standard article format because there were so many FOREX patterns setting up. We outlined 9 of those patterns above. Hopefully you find at least one that is suitable for your style of trading!

PS: don’t forget – if you have questions about the techniques used in this article, a simple 1 hour technical analysis coaching session can get all your questions answered!