US Equities In A Holiday Week

21

November, 2016

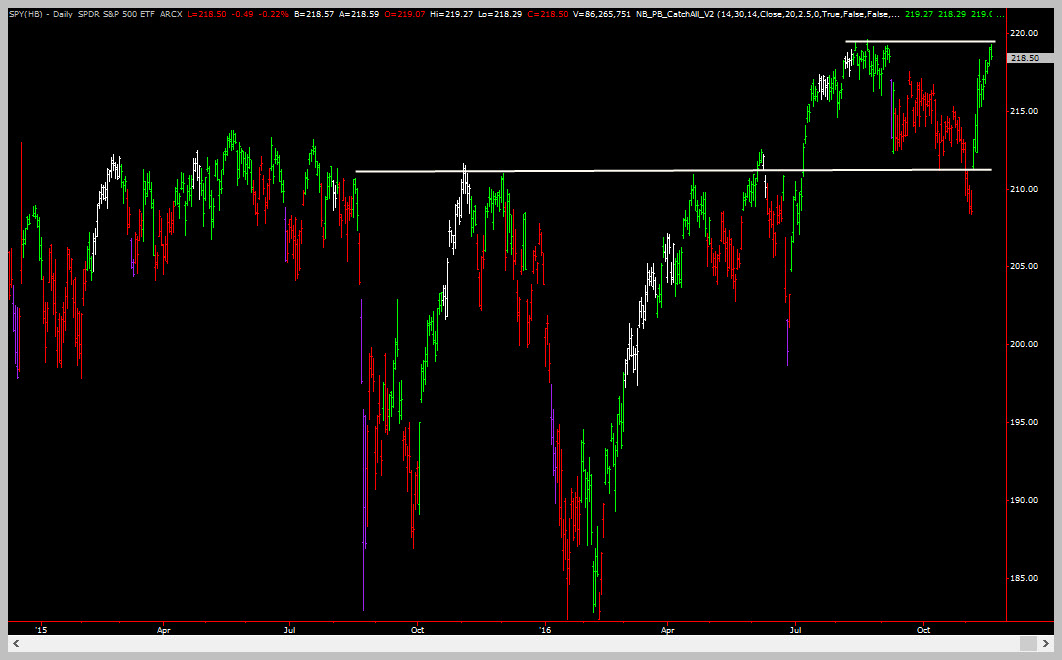

US Equities are at an interesting point. The DOW has pushed to new highs as has the small caps index (Russell 2000). But the S&P 500, the broader measure of the US Stock market and the Nasdaq, the market leader for many months, have both been lagging and have not made closed at new highs – YET.

The ES Futures (Dec 2016 contract) pushed to new highs last week but still did not CLOSE there. And the SPY and QQQ never made new highs at all.

Recently, we posted an article that suggested you should exit a portion of any ES/SPY positions you hold – until you see what happens. We believe that if these two lagging indexes are going to make new highs, its going to happen this week. Look how close we are to new highs…

The rationale for our expection is very simple – we are entering what is usually the most bullish time in the US stock market. And holiday weeks, in general, tend to have an extra-bullish bias. I’m not going to bore you by posting a bunch of numbers in a table – you can find a detailed analysis of this phenomena here.

Given how close the S&P is to new highs, the bullish bias this time of year practically dictates that the market make a solid good faith effort to get there. Otherwise it will have to wait for December!

So, lets look for the following trade setup this week

Entry #1: Enter a long trade on any pullback towards 2160 in the ES as long as the SPY has not made new all time highs.

Target: New All-time Highs – take half your position off when you get there; trail a stop on the 15 min charts for the other half.

Protective Stop: 20 ES points below your entry price

In the event that the SPY / S&P 500 Composite CLOSES at new highs:

Entry #2: Buy the DOW e-Mini (YM) at the market – it’s the strongest index right now so we want to own the strongest on breakouts. The ES closing at breakout levels simply confirms the strenght of the overall market.

Target: None – trail a stop 2 swing points back on the 15 min charts

Protective Stop: Trail a stop 2 swing points back on the 15 min charts

ES/SPY Critical point -still!

Photograph provided by canstockphoto.com

Wrap Up

There are two LONG trading opportunities in the SPY/ES that are liable to present over the next 48 hours. How to trade either or both of them are the trade ideas for this edition of our publication.

PS: don’t forget – if you have questions about the techniques used in this article, a simple 1 hour technical analysis coaching session can get all your questions answered!